40 us treasury coupon rate

U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. US 10-Year Government Bond Interest Rate - YCharts 31.03.2022 · US 10-Year Government Bond Interest Rate is at 3.13%, compared to 2.90% last month and 1.51% last year. This is lower than the long term average of 5.91%. Report: European Long Term Interest Rates: Category: Interest Rates Region: United States: Source: Eurostat: Stats. Last Value: 3.13%: Latest Period: Jun 2022: Last Updated ...

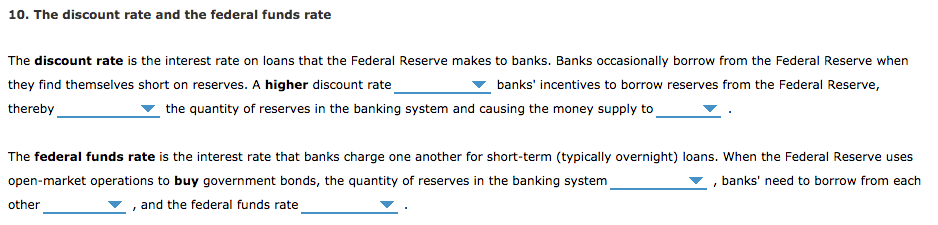

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Us treasury coupon rate

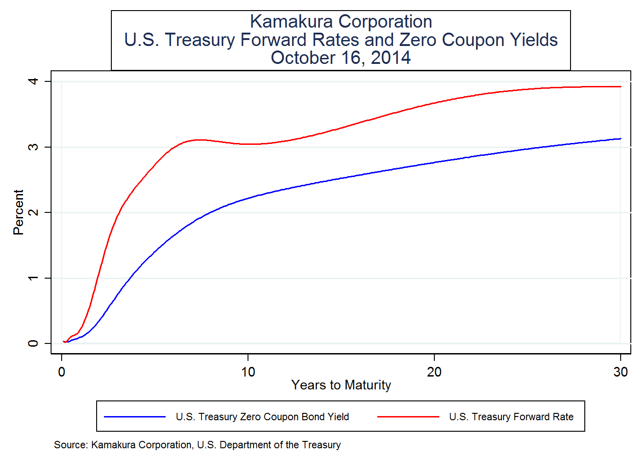

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve. From the data product: US Federal Reserve Data Releases (60,654 datasets) Refreshed 10 hours ago, on 7 Jul 2022 Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding ... Are most US treasury bonds which pay coupons of fixed interest rates? Answer (1 of 5): Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: * Bonds that ma... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

Us treasury coupon rate. Government - Continued Treasury Zero Coupon Spot Rates* 14.08.2013 · Contact Us; Applications & Programs; Reports; Interest Rates ... Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. Prompt Payment Act Interest Rate. Monthly Interest Rate Certification. Quarterly Interest Rate ... Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of ... Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. Prompt Payment: Interest Calculator 30.06.2022 · To use this calculator you must enter the numbers of days late, the amount of the invoice in which payment was made late, and the Prompt Payment interest rate, which is pre-populated in the box. If a payment is less than 31 days late, use the …

10-Year T-Note Overview - CME Group Futures and Options. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading ... The Basics of US Treasury Futures - CME Group - CME Group Coupon Yield – interest rate of a security fixed at issuance, usually expressed in annual terms. For example, a 2% bond pays 2% interest annually. Treasuries are quoted in coupon yield expressed in annual terms but pay interest twice per year. CTA – Commodity Trading Advisor, designation applied to registered advisors of commodity funds. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ... Individual - Treasury Bonds: Rates & Terms We used to issue Treasury bonds in paper form. The last paper bonds matured in 2016. For information on paper Treasury bonds, contact us: Send an e-mail. Call 844-284-2676 (toll free) Write to: Treasury Retail Securities Services. P.O. Box 9150. Minneapolis, MN 55480-9150.

US20Y: U.S. 20 Year Treasury - Stock Price, Quote and News - CNBC Coupon 3.25%; Maturity 2042-05-15; Latest On U.S. 20 Year Treasury. There is no recent news for this security. ... Advertise With Us. Join the CNBC Panel. Digital Products. News Releases. State of NJ - Department of the Treasury - NJDPB | Rate … Contact Us; Home; Rate Renewal Reports; Rate Renewal Reports. All archived rate renewal reports older than three years may be requested by contacting the NJDPB. ... 1996- Department of the Treasury Division of Pensions & Benefits P.O. … Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.59%, compared to 3.64% the previous market day and 2.13% last year. This is lower than the long term average of 4.37%.

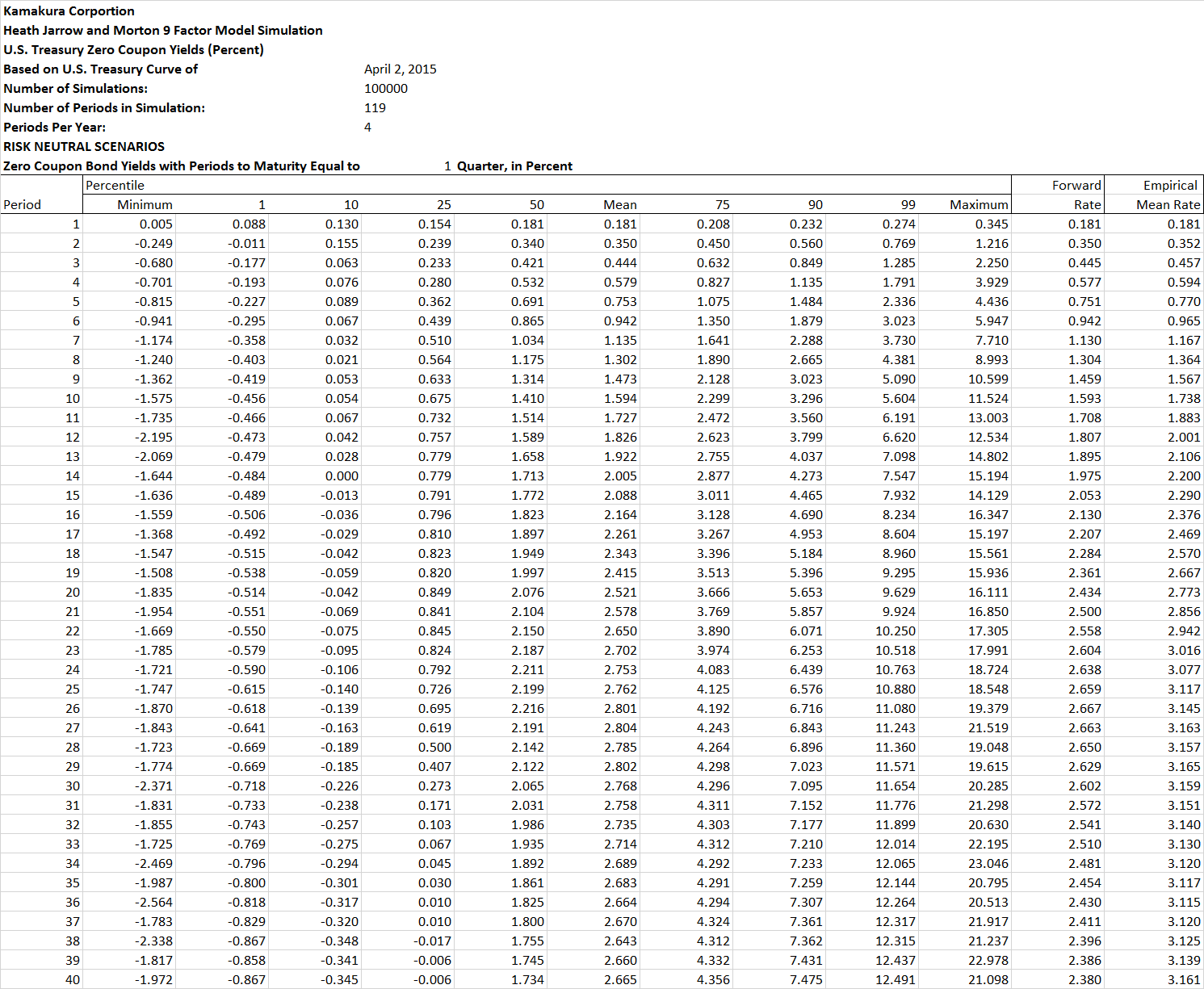

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-06-24 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ...

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

30 Year Treasury Rate - YCharts The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years. The 30 year treasury yield is included on the longer end of the yield curve and is important when looking at the overall US economy. Historically, the 30 year treasury yield reached upwards of 15.21% in 1981 ...

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

5 Year Treasury Rate 29.06.2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 2.96%, compared to 2.82% the previous market day and 0.81% last year.

US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) ... US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity:

10-Year US Treasury Note - Guide, Examples, Importance of 10 … 04.02.2022 · Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

What Is a Treasury Note? How Treasury Notes Work for Beginners Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields. Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities. ... The United States ...

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ...

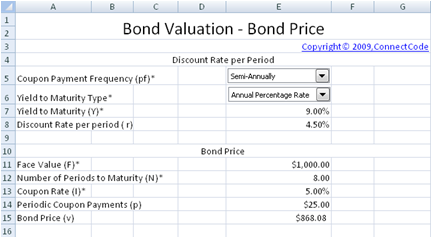

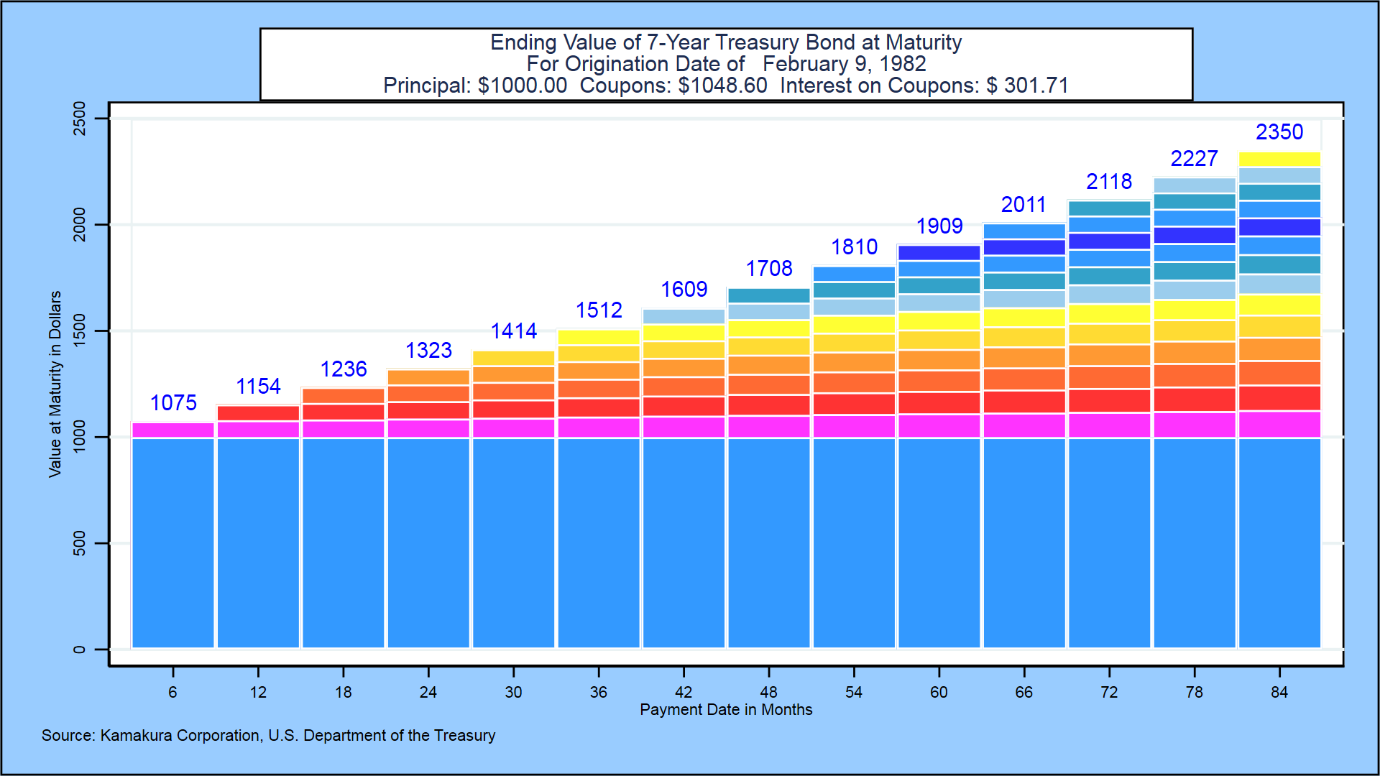

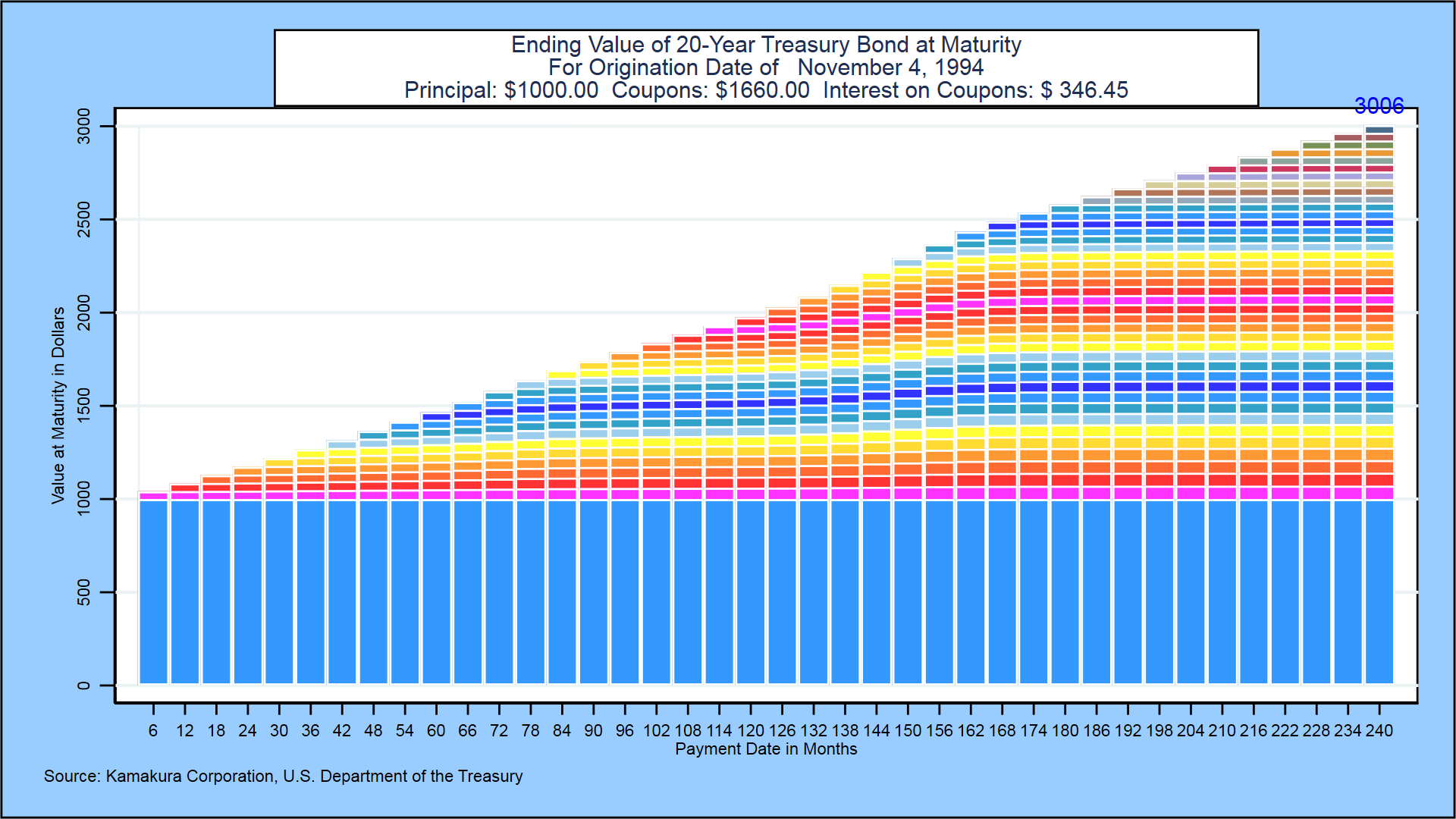

Treasury Return Calculator, With Coupon Reinvestment This treasury return calculator computes the return on 10 year US Treasuries with all coupons and payouts reinvested. Also, we can adjust for inflation. ... A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield ...

How Is the Interest Rate on a Treasury Bond Determined? 05.02.2020 · But it also means that Treasury rates are comparatively modest. As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. That is a …

Beat Inflation With A Risk Free 7% U.S. Treasury Bond At 3% this would make the year-over-year inflation rate 5.1% in March 2022. The total return calculation is: First six months return: $356 or one-half of 7.12% on $10,000. Second six months return ...

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

10 Year Treasury Rate - YCharts Jun 29, 2022 · Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.09%, compared to 3.01% the previous market day and 1.30% last year.

Treasury Bill Rates - NASDAQ - Datastore Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed 5 months ago, on 4 Feb 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a ...

5 Year Treasury Rate - YCharts Jun 30, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.13%, compared to 3.05% the previous market day and 0.74% last year.

Post a Comment for "40 us treasury coupon rate"